If all else fails, flat fee-paid advisers tend to have less of an incentive for conflicts of interest.Start by entering your monthly income in the sections below. X Research source Only use the services of advisers that you know and trust.

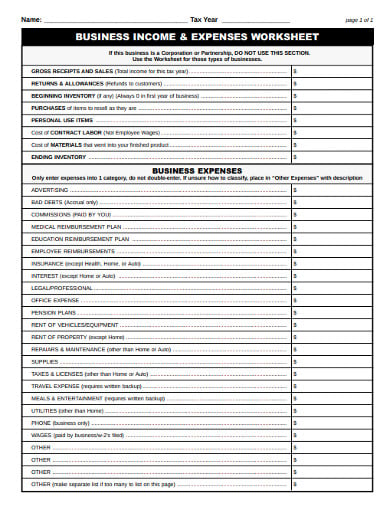

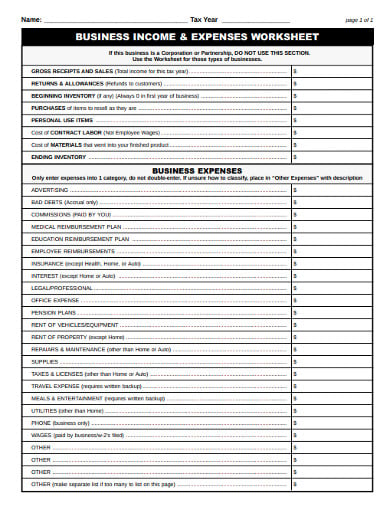

A word of caution: because their pay is determined by how much you buy and sell, some commissioned investment advisers have been known to act unethically, convincing clients to ditch old stocks and buy new ones frequently in an effort to line their own pockets. In this case, since 2% of the $10,000 we want to invest is $200, we'll add this to our total cost. This is only for example purposes - in the real world, it's usually either one form of payment or the other, not both. In our example, let's say that, on top of her flat fee, our adviser also charges a 1% commission. The more money you invest, the smaller the percentage usually is. This is generally a small percentage of whatever you buy through the adviser. Another way to pay your adviser for handling your investments is in the form of a commission. Adding up our expenses, we get total variable costs of $16,000. In addition, our factory uses a large amount of natural gas for the rubber vulcanization process and this cost increases as production ramps up - this month's utilities bill was $3,000. In our basketball factory example, let's say that our variable costs include: rubber = $1,000, shipping = $2,000, factory worker wages = $10,000. For example, since a robotic car factory uses a large amount of electricity and since the amount of electricity needed will increase as more cars are produced, utilities can be classified as a variable cost. X Research source In addition, utilities can be a variable expense if they fluctuate with the output of your business. Variable costs for a business include things like raw materials, shipping expenses, labor that is involved in the production process, and so on. X Research source In other words, the more a business creates (in terms of products produced, services rendered, and so on), the greater its variable costs will be. A business's variable costs are the expenses that are directly affected by the amount of goods or services produced. In business, variable costs are a little different than they are for personal budgets. Adding these up, we get a value for our fixed costs of $18,000.įigure out your variable costs. In addition, we pay $7,000 per month for workers that don't directly affect the production of our basketballs - janitors, security guards and so on. Our monthly fixed costs include: building lease = $4,000, insurance premiums = $1,500, loan payments = $3,000, and equipment = $2,500. For example, let's say that we own a basketball factory. A business's fixed costs include rent, utilities, building leases, equipment, machinery, insurance premiums, and labor not involved in the production of the goods and services.

Fixed costs for a business are similar to (but not exactly the same as) those for a personal budget.

More accurately, we can say that fixed costs are the costs that do not increase or decrease as the business produces more or fewer goods and services. This is the money the business needs to spend simply to keep operating. In the world of business, fixed costs are often referred to as overhead costs. If you use credit or debit cards to make all of your purchases, you can simply add your expenses at the end of the month by using your online banking profile (nearly all checking accounts and credit card accounts now give you this option for free.) On the other hand, if you make lots of cash or check purchases, you'll want to save your receipts or write down the amount of money you spend with each purchase.Īdd up your business's fixed costs.

Tracking variable costs can be a little more difficult. Groceries can be a little messier to keep track of, but if you keep your receipts or monitor your checking account transactions online, it shouldn't be hard to get an accurate total.

Tracking fixed costs is easy - simply keep track of your housing expenses (rent, etc.) and save every major monthly bill you receive for that month and you'll have a good deal of the work done.After this, you'll have a good idea of your fixed costs, so you'll only need to track your variable costs in the future.

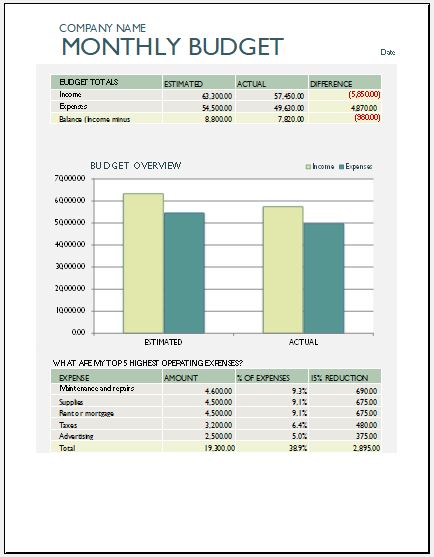

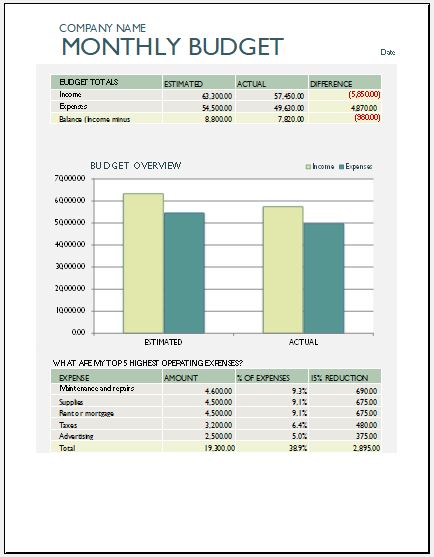

CALCULATE MONTHLY EXPENSES FULL

To remove guesswork from the equation, try actively tracking your expenses for one full month. This means that you can run into problems when you have to total up all of your expenses at the end of the month. Unless you're already practicing very good financial habits, you may not keep track of every single expense in a given month. Track your spending to determine your monthly expenses.

0 kommentar(er)

0 kommentar(er)